WHAT IS AN OFFSET ACCOUNT?

You can save hundreds, even thousands of dollars in interest payments, if you just play your cards right.

Mortgages have become a way of life for Australians. In fact, According to the Australian Bureau of Statistics, 74% of Australian households hold some kind of debt in 2015-16 with the average value of the debt being $168,600. Since mortgages are such a big part of the Australian lifestyle, it is essential for every citizen to understand how to manage these mortgages well. They must know each and every feature and technique available to them so that they can use them to make their mortgage burden lighter. One such highly effective tool in mortgage management is an Offset Account.

Do you want to pay lower interest? Who doesn’t! Then, an offset account is a feature you should know about. Let’s dive in.

HOW DOES AN OFFSET WORK?

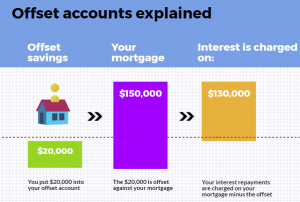

Let’s start with the basics first. An offset account is exactly what it sounds like. It offsets your loan amount. It is a simple bank account, but this one is linked to your mortgage account. The magic of offset account is that any money you put in this account slashes the interest you must pay on your home loan. How does this happen? Well, the amount you put in the offset account is deducted from the principal while calculating the interest amount. Hence, the interest payable goes down.

IS AN OFFSET A GOOD CHOICE?

AN EXAMPLE OF AN OFFSET ACCOUNT

You already have a general understanding of how offset account accounts. This example will hammer the concept in.

Let’s say that you take out a home loan of $600,000. The interest rate on the home loan is 5% and it comes with a 30-year term. You also have the feature of an offset account with the loan. Then, here’s how the math works out.

Let’s see what kind of a dent a 100% offset account can make on your interest payments. Let’s take the same loan and interest rate as the example above. If you have a 100% offset account attached to your home loan account and you deposit $50,000 into it, then the entire $50,000 will be offset from your principal amount. What does that mean? It means that you will only be charged the interest on $550,000. What if you maintain that kind of balance in the account for the whole repayment period? You will be saving almost $146,000 in interest payments.

Here is another example:

That is a lot of money that can be directed towards savings for your future, getting work done in the house, or maybe even go on a luxurious family holiday.

THINGS TO LOOK OUT FOR

Offset account is an incredible feature. It gives borrowers a lot of power over their current mortgages. While the offset account is a tool that you should explore, there are things that you should keep in mind before taking a plunge head first.

Before you get yourself an offset account, you should consider a number of factors. Ask your broker or lender about the interest rate you will have to pay on a home loan with or without an attached offset account. It may be the case that the loan products that offer offset accounts come with higher interest rates.

Then, there is the case of monthly fee or an annual fee (Most lenders will offer packages with an annual fee that will provide you more features). If your lender is offering you the feature of an offset account, then it is possible that they may charge you a fee for this facility. In fact, this is quite understandable since they are providing you an additional service. But, on your part, you should be sure that you understand the fee structure completely.

SHOULD YOU HAVE AN OFFSET ACCOUNT?

Do your research. It is vital that you are aware of every cost inherent to the loan. Only then will you be able to get an accurate idea of the savings you will make. Even small expenses can accrue over time to become big on a 30-year horizon and then shave off a considerable amount of money from the savings that you had anticipated. So, it is crucial for you to take these pointers into account.

It would also be wise to consult a mortgage expert to understand offset accounts and how you can benefit from having one.

FEEL FREE TO CONTACT US FOR AN OBLIGATION FREE DISCUSSION.

Finance Circle Group

The information on this website is general information only and is not intended to be a recommendation. We strongly recommend you seek advice from your financial adviser as to whether this information is appropriate to your needs, financial situation and investment objectives.