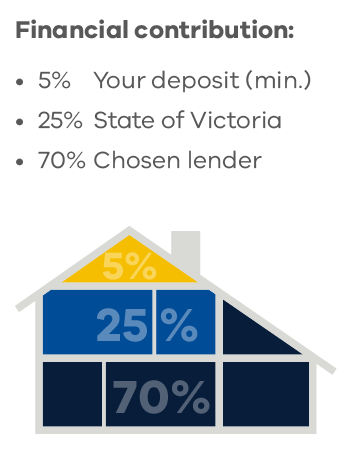

The state has launched a new home-buyer fund, under which it will pay 25 per cent of the property purchase price if eligible borrowers have a 5 per cent deposit.

The Victorian government has introduced the $500 million Victorian Homebuyer Fund (VHF), which is expected to support more than 3,000 home buyers.

Under the VHF, eligible participants will only require a minimum deposit of 5 per cent, while the government will provide up to 25 per cent of the purchase price in exchange for an equivalent share in the property.

The remaining 70 per cent would be financed by the home buyer’s chosen lender. Note that note all banks participates in these schemes. As at 11 Oct 2021, The lender participants currently include Bank Australia and Bendigo Bank.

To be eligible to participate in the fund, home buyers need to:

- Be an Australian citizen or permanent resident over the age of 18 years, who currently do not have an interest in a property and who meet the income thresholds

- Have a gross annual income of $125,000 per annum or less for individuals or $200,000 or less per annum for joint applicants

- Be a natural person (that is, not an organisation, company, trust or other body or entity)

- Occupy the purchased property as their principal place of residence

- Not purchase the property from a vendor who is related

- Not own any interest in any land at the time of purchase (including as trustee of a trust or beneficiary under the trust)

- Not be acting as a trustee of a trust

- Not be a shareholder in any corporation (other than a public company) that owns any land

If subsequent assessments by the state and a participating lender are approved, eligible participants must become registered owners of the property they purchase.

Home buyers can buy out the government’s share at market value over time if they choose, with funds then reinvested to help other prospective home buyers enter the market.

Contact us for more information:

info@financecirclegroup.com.au

www.FinanceCircleGroup.com.au

Here is how the contribution will work:

https://www.sro.vic.gov.au/am-i-eligible-homebuyer-fund

Eligible locations and properties

The property you purchase must be in Metropolitan Melbourne, Geelong or another eligible regional location. For the full list of regional locations please read the eligible locations page.

Your ongoing obligations

If approved for the Homebuyer Fund, there are a range of ongoing obligations you are required to fulfil.

Annual review

Each year following the purchase of your home, you will be required to complete an annual review and provide supporting information to ensure you have maintained your eligibility for the Homebuyer Fund.

This may include providing a certificate of currency of insurance and other details such as payslips, tax returns, home loan statements and utility bills.

You are also required to notify us within 10 business days if your circumstances change at any point in time.

Insurance

Your property must always be insured, and you are required to provide a certificate of currency during each annual review period.

Maintaining your property

You are required to maintain your property, keep things in good working order and fix any defects.

You must seek approval before making any modifications or renovations of more than $10,000; or those that involve structural changes or require authorisation, such as council approval.

You also must seek approval to refinance your property, sell your property, or make voluntary payments that result in you exiting the Homebuyer Fund within the first two years.

Repayments

You must make payments on time, such as council rates, utilities, body corporate fees, stamp duty and home loan repayments.

You are required to start repaying the Homebuyer Fund’s interest in your property when:

- Your gross annual income exceeds the applicable threshold on two consecutive annual review reporting dates, or

- You receive a windfall gain such as an inheritance or lotto win of $10,000 or more, or

- You have made a mandatory payment and your gross annual income at the next reporting date has increased by 10% or more, and

- You are approved by your lender to increase your home loan. The loan increase will only proceed if it enables you to make a payment to reduce the Homebuyer Fund’s share by at least 5 percentage points i.e. from 25% to 20% and is at least $10,000. Please note you are required to use your best endeavours to increase the loan if your income exceeds the applicable income threshold, or you have made an earlier mandatory payment.

You can make voluntary (extra) repayments to start repaying the Homebuyer Fund’s share, provided:

- Each repayment reduces the Homebuyer Fund’s share in your property by at least 5 percentage points i.e. from 25% to 20%, and is at least $10,000.

You need to seek and gain approval from the Homebuyer Fund team to pay the full amount back in the first two years, or reduce the State’s equity below 5 percentage points i.e. from 25% to 4% in the first two years.

If your property is sold, the money is distributed to the following entities in this order:

- Your bank to pay off your remaining home loan.

- The Homebuyer Fund to pay back its share in your property.

- Anyone else with a legal or equitable interest in the property, such as council rates.

Information given in this article is general in nature and is not intended to influence readers’ decisions about investing or financial products. They should always seek their own professional advice that considers their own personal circumstances before making any financial decisions.

Feel free in getting touch with us – NO OBLIGATION and we will help where we can.

Nirosh Weerasinghe 0401 976 188

Chamila Suraweera 0402 927 220

Shane Cross 0421 427 272

Sumeet Agrrawal 0431 237 935

We will work side by side with you through this challenging times.

info@financecirclegroup.com.au