Your credit score, may also referred to as Equifax Score, is used by some of your potential lender to determine the risk of offering a loan to you. This is an automated rating system and based on your credit file as well as the information you have provided in your loan application.

Covid period have been hard on everyone, but many people are taking the opportunity review their plans and put positive steps in place for their financial affairs. They have hopes and dreams of taking holidays as well as buying, building, or renovating a new home. Part of this process should include ensuring that credit reports are protected and that your clients are putting their best foot forward if they need to take out a loan.

Here are 10 tips you can share with your family and friends to help them protect their credit reports:

1. Don’t enquire for finance online

As a Finance and Mortgage Broking firm, we see many consumer reports every week and we see lots of people making the mistake of applying online for finance. In some cases, they have panicked and enquired 10 or more times over a weekend for a personal loan or a credit card which has negatively impacted their credit score and credit report. The harsh reality is that these enquires cannot be removed unless they are fraudulent or incorrect and the only thing that can be done is to wait for the affect of those enquiries to wear off over time which could be two years or 5 years depending on the damaged caused.

2. Check your credit report and score on a regular basis

We have three credit reporting agencies in Australia for consumer reports – Equifax, Experian and Illion. Credit providers can be inconsistent in regard to how they check credit reports. We do know that its more common for lenders to check the Equifax report but you can’t be sure that they are looking at Illion and Experian. It is an option to sign up to get your score month or half-yearly, which costs around $10 per month.

7 Steps For Working Towards Improving Your Credit Score

3. Be mindful of buy now pay later loans

Short term buy now pay later loans which are quick and easy to sign up for can be bad for our credit scores. In-fact, just one payday enquiry can lower your score by up to 150 points. A better approach is to save your money and buy from your savings, which doesn’t affect your credit report.

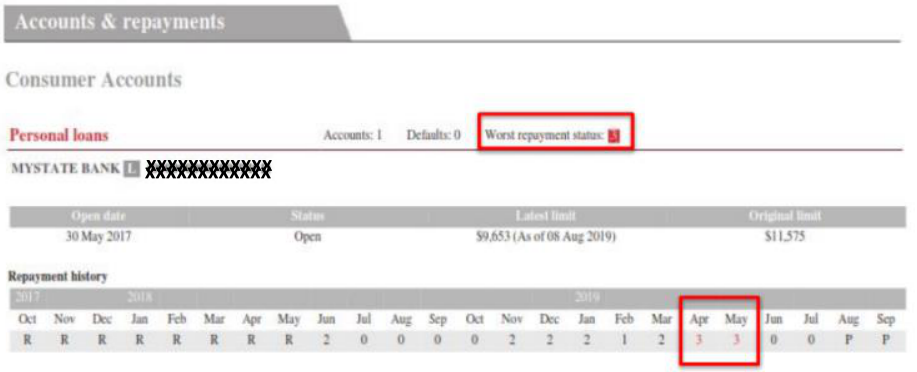

4. Make sure you pay your bills on time

Make sure you know your due dates for payments so you don’t affect your credit report with an accidental missed payment. Missing one repayment can damage your credit report and credit score with repayments on most accounts now listed on a credit report for 24 months.

5. Set up Direct Debits for your bills

A great way to stop worrying about bills is to set up a direct debit for your repayments. That way, you don’t have to worry about missing a repayment and destroying your credit report. You can also avoid payment fees on direct debit, versus credit card payment which can have hidden charges. If you have a credit card set up for direct debits, ensure that you have enough funds in the credit cards; otherwise, your credit card provider will charge you overlimit fee.

6. Contact your Credit Provider if you are experiencing financial difficulties

Consumers have a 15-day grace period to make a payment from the due date on debts.

That means, if you know you can’t make your payment this month, you have some time to contact your credit provider. Call or email them to request temporary financial assistance which will protect your credit report from any negative repayment history information. Once you agree on the repayment plan, it is important that you honour that commitment.

7. Organise deferrals on loans if you need to

In 2022, many lenders are still offering deferred repayments. You can also ask for a temporary freeze on accounts for 3 to 6 months. Call your credit providers or email them and ask them for help because, asking arrangements ahead of difficulty can save your credit report for the future.

8. Put some savings away if you can for emergencies

Most families live week to week, so when a crisis comes up, it’s difficult to cope. Putting away $50 or $100 a month can help if something unexpected crops up, especially in the current environment where there is so much uncertainly.

9. Be mindful of fraud

Many more consumers have been contacting us recently because of fraudulent data on their credit reports. Removing this data is possible but it does take between 4-8 weeks. It is important that credit reports are checked regularly and keeping personal data online secure. A great way to protect yourself is to use two-way authentication.

10. Pay down your credit cards if possible

You can improve your credit report by lowering your credit card limits. Also ensure that you pay extra towards your credit card so that you can reduce your balance.

One-stop finance

Finance Circle Group do much more than arrange finance for home loans. We can help to identify and secure commercial and asset funding to enable your growth, while at the same time preserving your operating cash flow.

We can be a one-stop-shop for your financing needs. Contact us to find out more about how we can help you with commercial and asset finance.

FEEL FREE TO CONTACT US FOR AN OBLIGATION FREE DISCUSSION.

Finance Circle Group

info@financecirclegroup.com.au

The information on this website is general information only and is not intended to be a recommendation. We strongly recommend you seek advice from your financial adviser as to whether this information is appropriate to your needs, financial situation and investment objectives.