In days gone by, customers were rewarded for being loyal, however, today this doesn’t seem to be the case.

The practise of charging more on mortgages for older loans, compared to discounting for new clients has become such common practice, the Reserve Bank of Australia has called the banks out on it.

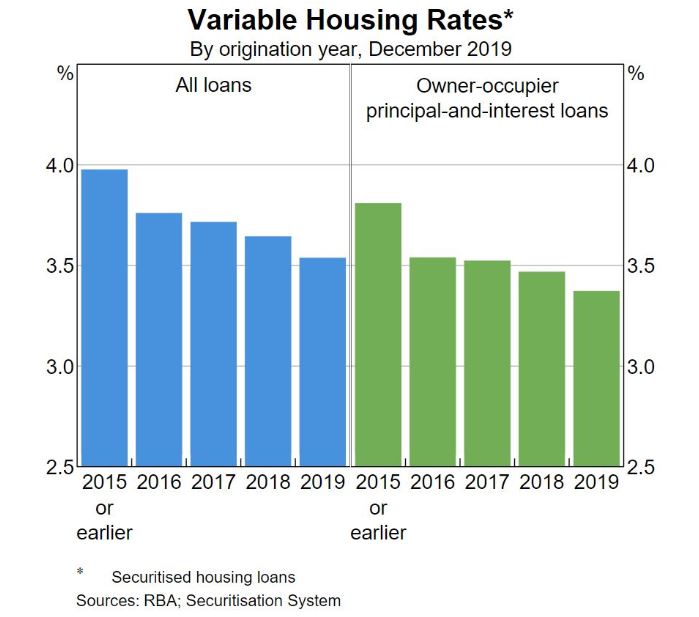

In its Statement on Monetary Policy the RBA in Feb 2020, it was note that for variable-rate mortgages, older loans typically have higher interest rates than new loans, even for borrowers with similar characteristics.

At a Glance:

- Borrowers with older loans are paying higher interest rates than those with new mortgages

- The RBA has found banks are offering discounts on their standard variable mortgage rates to new customers

- Customers with a $500k mortgage can save up to $2,000 a year in interest

“This means that existing borrowers who are able to refinance with another lender or negotiate a better deal with their existing lender can achieve interest savings,” said the policy.

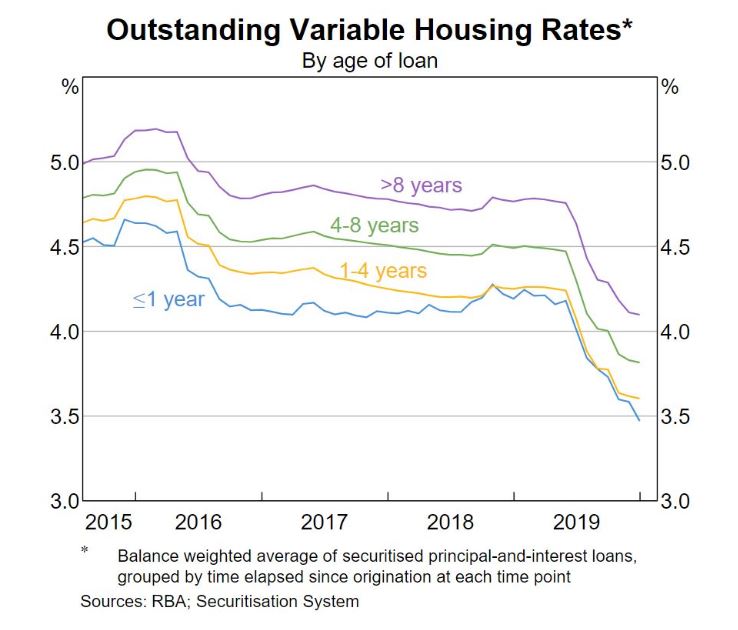

That is especially the case if your loan is more than four-years old.

“Currently, these loans have an interest rate that is around 40 basis points higher than new loans,” said the policy.

For a loan balance of $500,000, this difference implies an extra $2,000 of interest payments per year.

BA’s policy said some of the differences in rates between older and newer mortgages can be explained by a shift in the mix of different types of variable-rate mortgages over time.

“In particular, the share of interest-only and investor loans in new lending has declined noticeably in recent years and these tend to have higher interest rates than other loans,” said the policy.

“Nevertheless, even within given types of mortgages, older mortgages still tend to have higher interest rates than new mortgages.”

“There is little doubt that Australians with long-standing home loans are paying higher rates than those who refinance or seek a new loan,” said Nirosh Weerasinghe , Director of Finance Circle Group.

Customers who successfully refinance a $500,000 loan and reduce their interest rate by approximately 0.90 per cent per annum could save more than $300 per month immediately, and in the order of $71,000 over the life of the loan.

Anyone with a home loan can speak to one of our brokers at Finance Circle Group or any other broker to put their mortgage on the market and see what the difference is between what they currently pay and what lenders are prepared to win them as new customers.

“This is the simplest and easiest way to see if you are paying a ‘loyalty tax’”, said Mr Weerasinghe.

In this article, originally published on The Real Estate Conversation, we weighed in on the loyalty tax and how Finance Circle Group is helping homeowners get the best rate on the market.