Self Managed Super – Limited recourse loan

Some people are interested in the ability to purchase property within a Self-Managed Superannuation Fund (SMSF). An SMSF allows you to invest directly in residential or commercial property using the funds accumulated in superannuation. If you want to purchase an investment property within your SMSF, but don’t have quite enough available capital, your fund may be able to borrow money for the purchase under a limited recourse borrowing arrangement (LRBA).

Although gearing can deliver benefits, the risks associated with gearing may mean it is unsuitable for you. It is essential to carefully consider these risks before proceeding with a gearing strategy. In most situations, an LRBA is used to purchase real property. However, it may also be possible to purchase direct shares or even managed funds using an LRBA (subject to certain conditions being met).

An LRBA can only be used to purchase a ‘single acquirable asset’. While an SMSF could purchase multiple assets using borrowed funds, multiple loans would need to be implemented so that the lender’s recourse is ‘limited’ to the single property or asset to which it relates.

How it works

There is a general rule that an SMSF cannot borrow under superannuation law. However, there is a very specific exemption for arrangements that meet all of the requirements of an LRBA. It is important to meet all of these requirements otherwise the fund will be in breach of the superannuation rules and may face penalties.

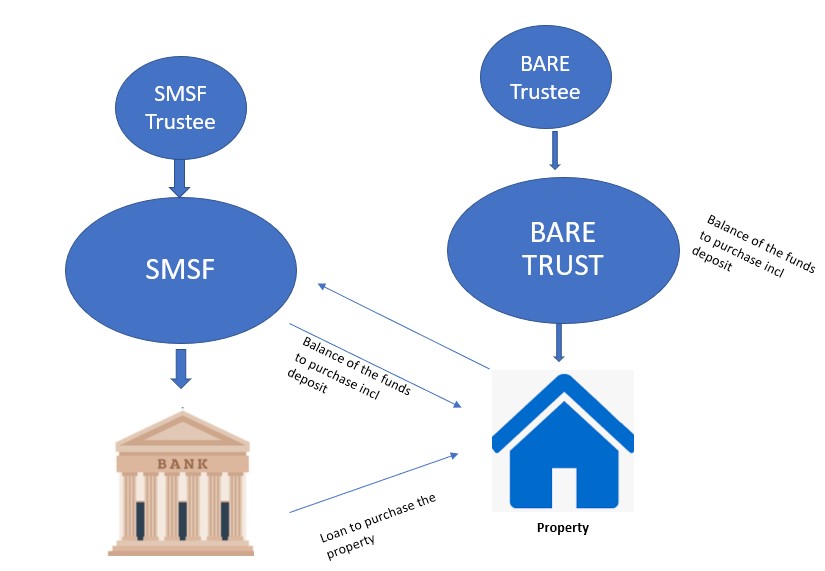

An LRBA is a loan structure where the only SMSF asset that the lender (or any other party) has recourse to is the asset that was purchased using the loan if the fund is unable to meet its loan obligations. It involves establishing a security (or bare) trust to legally hold the asset on behalf of the SMSF, i.e. a trust that only holds the asset, for the duration of the loan.

There are many names for these types of trusts, but they are all bare trusts; they don’t perform any function or transactions other than holding the asset. Most lenders will require the trustee of the holding trust to be a corporate trustee.

The trustee cannot be the same company as the SMSF corporate trustee; however, it may have the same directors as the SMSF corporate trustee (i.e. the members). This ‘bare trust’ arrangement broadly recognises that the asset is to be held by the security trust until the debt is repaid, at which point legal ownership can pass to the SMSF.

You also need to remember that not every property can be purchased in an SMSF; it must meet the following criteria:

• must meet the ‘sole purpose test’ of solely providing retirement benefits to fund members

• must not be acquired from a related party of a member (unless exemption applies under the legislation)

• must not be lived in by a fund member or any fund members’ related parties

• must not be rented by a fund member or any fund members’ related parties (unless exemption applies under the legislation – which generally relates to a property that meets the definition of ‘business real property’).

Once you decide that purchasing a property using an LRBA is the right strategy for your SMSF, you need to ensure your SMSF’s trust deed allows the fund to borrow. If it doesn’t, you will need to update the trust deed to allow the fund to borrow before entering into the arrangement.

The purchase of the property should also be consistent with the SMSF’s investment. Again, if the investment strategy needs to be updated, this must be completed before the purchase takes place. Then you need to set up the security trust, select the property (ensuring you buy it in the name of the holding trust) and engage with a lender to obtain finances, and settle on the property by using the loaned funds (and any SMSF money) to complete payment. Your fund can then begin receiving rent payments in the SMSF bank account and making loan repayments to the lender. It is summarised in the diagram below:

Step by step for property purchase in the SMSF:

To comply with the borrowing rules, we recommend the trustees of the SMSF to seek accountant or financial planner advice. Below information is for general guidelines that may useful to purchase the property in the SMSF:

1. Check the trust deed and investment strategy:

It is to ensure the borrowing and property investment is allowed in the fund. Update the trust deed and investment strategy if necessary. This can be undertaken by your accountant with specialised knowledge on SMSF to ensure all the documents are up to date before the purchase.

2. Find the property that the SMSF will buy:

The trustees of the SMSF should find a suitable property for the SMSF and advise us of the address and property details.

3. Apply for loan pre-approval:

We recommend you speak to a finance broker to see if you can satisfy lender requirements. There are so many lenders on the market, and a finance broker will assist you with the list of lenders that may suit your needs and objectives. It is your choice to get the best deal for your SMSF.

Most of external lenders have a maximum loan to valuation ratio (LVR) 70-75% and require guarantees from the members/trustees in their personal capacity. The lender may require the trustee to provide information, like superannuation contributions, proposed rent and other income, to ensure the repayments can be made.

4. Pay Deposit to the Vendor:

The trustee of the SMSF may be required pay a deposit to the Vendor or vendor’s agent (normally 10% of purchase price) for the underlying property. Please be noted that the receipt of the money should have the name of the trustee of the SMSF as the purchaser.

5. Establish corporate trustee for the custodian/bare trust:

The company can have one or all the members of the SMSF as directors / shareholders. This company can be the trustee for multiple custodian/bare trusts.

The corporate trustee of the SMSF cannot also act as trustee of the custodian/bare trust. So, you will have two separate companies if the trustee of the SMSF is a company. It is important to check with the accountant if the rules with regard to SMSF has changed as the policies can change from time to time.

For the corporate trustee of the custodian/bare trust, we recommend setting up a is a newly established company or has never traded before; it’s only purpose is to hold the asset in trust for the trustee of the SMSF.

Note this company is not a “Special purpose company”, which means that this company will pay normal Annual ASIC Review Fee each year. There is no need for this company to have a tax file number, ABN or a bank account etc.

6. Establish the custodian/bare trust:

The custodian/bare trust will be established by the trust deed. The property address must be embedded in all documents including Property Custodian Trust deed (PCT deed) and related documents.

Note that the trust deed must be stamped with State Revenue Office before transfer of property. Amount of Stamp duty depends on the state laws where the deed is executed. These requirements change from time to time; hence it is advisable to check with your local office.

7. Purchase the property:

The buyer of the property on the purchase contract document MUST be the name of “trustee of the custodian/bare trust”. You need to ensure that <name of the trustee of the custodian/bare trust> appears on the transfer records and not the <name of trustee of SMSF>.

8. Loan Approved by the lender:

The lenders will send you the confirmation for the final loan approval and you can sign and return them as instructed.

9. Property settlement:

At the time of settlement – the bank lender pays the amount lent directly to the vendor on instructions from the trustee of the SMSF and trustee of the custodian/bare trust. The SMSF pays the balance amount to the vendor and other related costs such stamp duty, legal fees etc. via bank cheques as instructed by the solicitor or conveyancer.

And now you can enjoy the benefit of borrowing in your SMSF!

One-stop finance

Finance Circle Group do much more than arrange finance for home loans. We can help to identify and secure commercial and asset funding to enable your growth, while at the same time preserving your operating cash flow.

We can be a one-stop-shop for your financing needs. Contact us to find out more about how we can help you with commercial and asset finance.

FEEL FREE TO CONTACT US FOR AN OBLIGATION FREE DISCUSSION.

Finance Circle Group

info@financecirclegroup.com.au The information on this website is general information only and is not intended to be a recommendation. We strongly recommend you seek advice from your financial adviser as to whether this information is appropriate to your needs, financial situation and investment objectives.