When it comes to securing a mortgage, your bank statements are a vital piece of information. They give lenders a snapshot of your spending habits, provide proof of income, and help establish that you’re a responsible borrower. So chances are you’ll need your bank statements for your mortgage application.

While in theory, pulling together your bank statements should be the easiest piece of the home-buying puzzle, this isn’t always the case. Some customers struggle to locate where to download their bank statements in their internet banking, aren’t sure how far back to go, or are uncertain whether they need their transaction history too.

That’s why we’ve put together this handy guide to getting your bank statements together to provide to your lender. From why they’re important to where to find them and what lenders are looking for in your bank statements, we’ve answered all your most pressing questions so that you’ll have that mortgage application approved in no time.

For your lender to accept this document as a bank statement, it needs to include:

- Bank name and logo

- Full name and address of the applicant

- Applicant’s account number

- Opening and closing balance of the account

Is a bank statement the same as transaction history?

It’s important to note that a bank statement is different from your transaction history. A bank statement is a list of transactions made within any given period (which you can choose yourself within your internet banking). Generally, you will be able to download this as a PDF file to send off.

It’s important to note that most lenders want to see both bank statements and your up to date transaction history. For an example, if your bank statement last issued on 31 March, and you are applying for a loan on 15 June, bank require Bank statement to 31 March plus transaction history from 1 April to 15 June. Transaction history may not have your account name, however only a bank account number. Banks will match the account number from the transaction history to the bank statements.

Why do you need to provide your transaction history?

As you can cover a longer period of time with your transaction history, they give lenders a clearer idea of your overall financial habits which helps support your mortgage application. They also tend to be more recent, as your bank statement is issued periodically while your transaction history shows everything up to the moment you generate it.

Do bank statements show transactions?

Yes, bank statements show your transactions. However, this will only be within a certain timeframe, as determined by the statement period chosen when the report was generated.

How far back do lenders check bank statements?

Most lenders will require two to three to six months of bank statements, as well as the transaction histories from that period. Generally, lenders will ask for bank statements no older than 30 days to support your mortgage application.

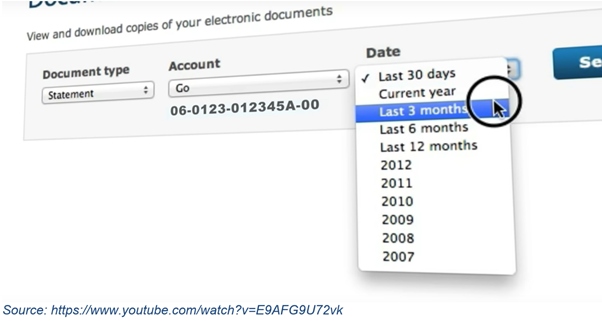

Can I get bank statements from 5 years ago?

Most of Australia’s main banks will allow you to view and print up to 7 years of bank statements within your online banking app. However, it’s highly unlikely that your lender would need to see records dating this far back. Usually, this only happens if there’s a particular blimp on your credit record that they need to address.

How long do banks keep records of transactions?

By law, financial institutions must retain a record for seven years after the transaction.

What are lenders looking for in your bank statements?

Your bank statements and transaction history give mortgage lenders an insight into your spending behaviours, how much you earn, your expenses and any debt obligations. Generally, the things they will be keeping an eye out for include:

Overdraft fees

This is a fee charged by your bank when you spend more money than what’s actually in your account. This can include dishonour fees from bills or transactions that have been scheduled to automatically go through, despite the money not being there.

Large, irregular deposits

These can be a red flag to mortgage lenders, as it can indicate that you’re receiving money from external sources – like parents. This can give a lender an inaccurate view of how responsible you are as a borrower, so all gifted deposits must be accompanied by a note from your parents.

Excessive or irresponsible spending

Lenders will check the living expenses you’ve listed on your mortgage application against your transaction history to ensure it all lines up. If they find that your spending is actually higher, or you’re using it on things like UberEats every night of the week, this can diminish your borrowing power or even make it difficult to obtain a loan.

How to get your bank statements and transaction history from your online banking

While some financial institutions send bank statements via mail, the best way to access them is through online banking.

Nowadays, most banks have an online access portal, meaning you can avoid going into the branch. To access your statements, you can usually use the app, but it’s easiest to view and print these using a desktop.

Each bank has a different process to download these, so it’s important to check the specific procedure for yours. Here, we’ve included a step-by-step guide to getting your bank statements and transaction histories from five of Australia’s biggest banks.

How to get your bank statements from different banks

CBA Commonwealth Bank

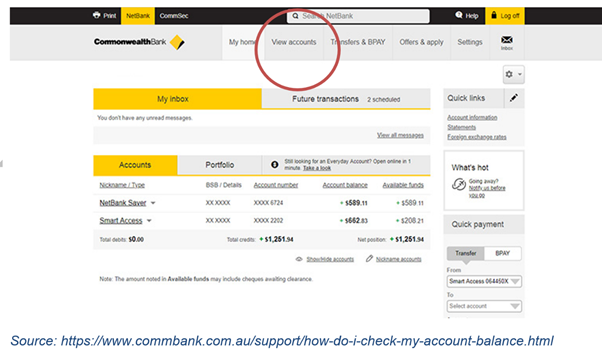

If you have a Commonwealth Bank account, you can use NetBank to access the required documents.

Bank statements:

- Log in to NetBank using your client number and password. Contact Commonwealth Bank if you don’t know what these are, as you may need to register for online banking.

- In the top menu, select ‘View accounts’, then ‘Statements’.

- Click on the account you need a statement for, then select the option for the most recent statement and click ‘Next’.

- Your bank statement should now be downloaded as a PDF, which you can email to your lender or broker

Transaction history:

- Log in to NetBank using your client number and password. Again, contact Commonwealth bank if you don’t know what these are.

- In the top menu, select ‘View accounts’, then ‘Statements’.

- Click on the account you need a transaction history for, then select ‘Go’.

- Find ‘Transaction Search’, then enter the date range you want to view. Click ‘Search’.

- Instead of exporting the transactions (as lenders do not accept this), press ‘Print Page’ on the top right-hand side of the screen to print the page or convert into a PDF to email to them.

You may need to scroll to the bottom of the page and press ‘print’ on each individual page if your transaction history is particularly lengthy.

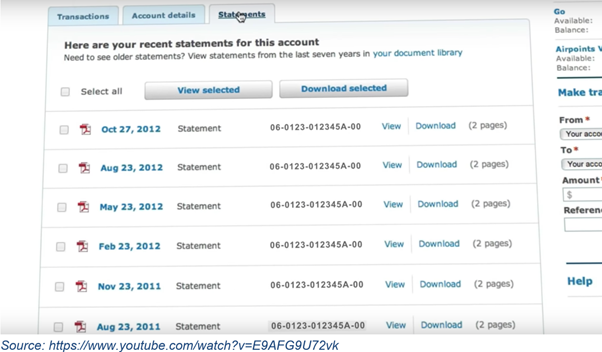

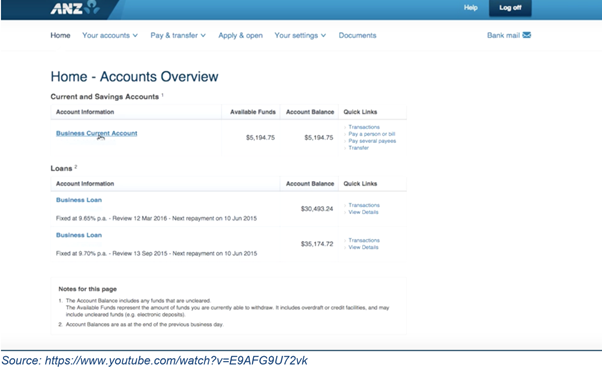

How to get your bank statements from ANZ

Bank statements:

- If you haven’t already, you’ll need to register for online statements with ANZ. You can do this by contacting the bank.

- Log in to your internet banking and select ‘Accounts’ in the top menu.

- Click ‘View Online Statements’, then follow the prompts to download your most recent statement.

Transaction history

- Log in to your internet banking and select the account you would like to view and download transactions for;

2. Next, click ‘Search Transaction,’ then select your desired date

3. Select ‘All Transactions,’ then click ‘Search’.

4. Rather than exporting, click ‘Print Copy’ on the top right-hand side of the screen, or convert it into a PDF to attach to an email.

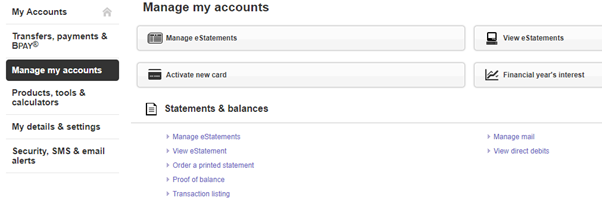

How to get your bank statements from St. George / Bank of Melbourne

Bank statements:

- Log in to your online banking.

- Click on “Manage my Accounts” and ‘eStatements’ or ‘view eStatements’.

- Click on the account you would like a statement for, then select ‘View Recent eStatement’.

- This should download the statement as a PDF that you can email to your broker

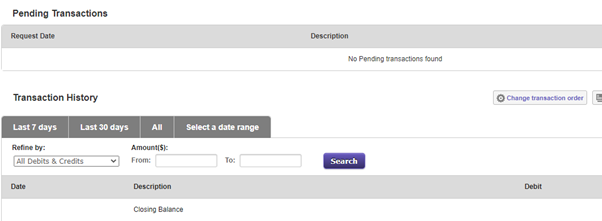

Transaction histories:

- Log in to Internet Banking.

- Click on the account you need a transaction history for.

- Scroll to the bottom of the page and use the ‘Refine Your Transaction History’ search box to select the desired date range.

- Rather than exporting your transactions, print the page or convert them to a PDF so that you can attach them to an email (Refer below how to save as PDF file).

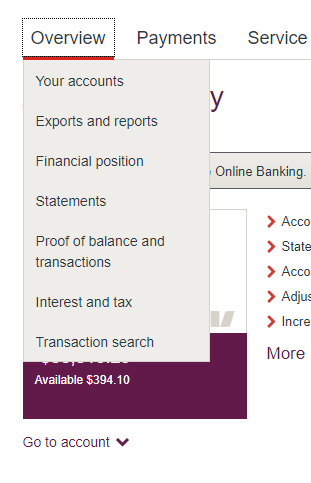

How to get your bank statements from Westpac

Bank statements:

- Sign in to Westpac Online Banking.

- Select the account you need a statement for.

- In the overview menu on the top left corner, select ‘Statement’.

- From the ‘Statements’, you will be able to see ‘active accounts’ and ‘closed accounts’; select the account that you need the statements

- Click ‘View’ then ‘Save or print a high-quality version of this statement’.

This should download the statement as a PDF you can email to your lender or broker.

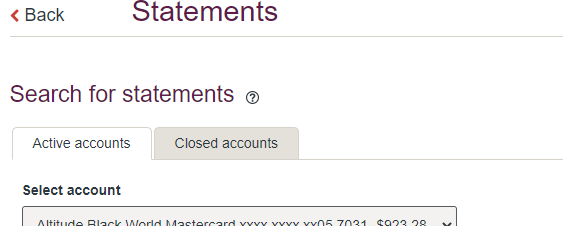

Transaction history:

- Sign in to Westpac Online Banking.

- Select the account you need a Statement for.

- Click ‘Transaction List’ in the top menu, then select and search for the required date range.

- Rather than exporting your transactions, print the page or convert them to a PDF ready to attach to an email.

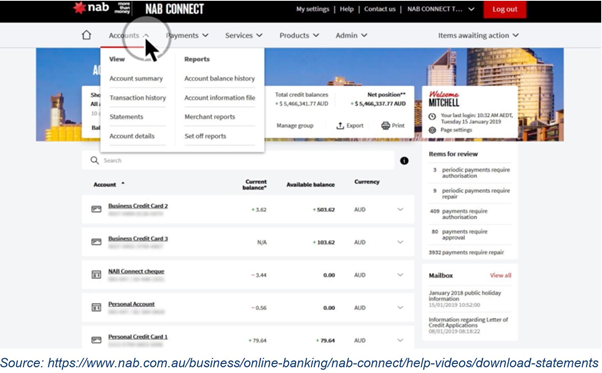

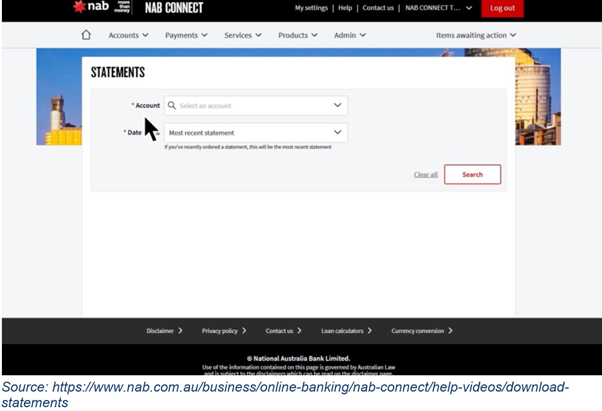

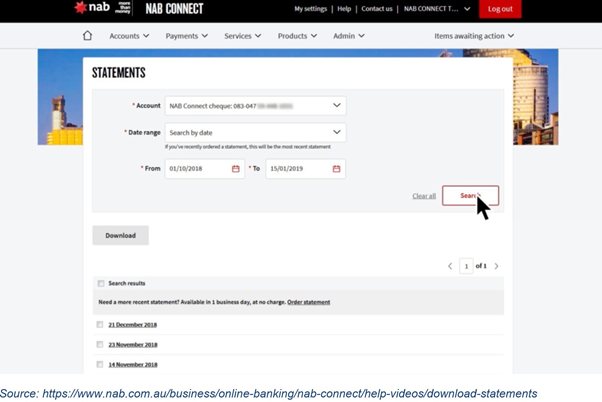

How to get your bank statements from NAB

Bank statements:

- Sign in to NAB Online Banking.

- Scroll down to ‘Statements’ on the left-hand side, under the tab ‘Account Info’.

- Click on the account you need a statement for, then select the most recent statement or your desired date range

4. Statements should appear by date sent. Select the one you want, and it will automatically download as aPDF

5. Save this as a copy to your computer, which you can email to your lender or broker

Transaction history:

- Sign in to NAB Online Banking.

- Select the account you need a transaction history for.

- Click ‘Show Filter’ on the top, left-hand side.

- Select and search for your desired date range then click ‘Display’.

- Rather than exporting the transaction, print the page by selecting ‘Print on the top menu bar’ or convert it to a PDF.

How to get your bank statements from Macquarie Bank

You can download statements for the following accounts from Macquarie Online Banking and the Macquarie Mobile Banking app:

- Macquarie Transaction Account

- Macquarie Savings Account

- Macquarie Cash Management Account

- Macquarie Cash Management Accelerator Account

- Macquarie Consolidator Cash Account

- Macquarie Vision Cash Account.

To download a statement from Macquarie Online Banking:

- Select Accounts from the side menu; or first click on the

icon in top left-hand corner to display the side menu

- In the Statements column, select View All to choose the statement period or select Latest to download the latest statement

- Once the file has finished downloading, access the statement from your browser status bar. You can then print the statement.

To download a statement from the Macquarie Mobile Banking app:

- Select the account name

- Select the Statements tab

- Choose the statement and select the icon to download the statement

- You can view the statement.

- Macquarie Transaction and Savings Account: Since account opening

- Macquarie Cash Management Account, Macquarie Cash Management Accelerator Account and Macquarie Consolidator Cash Account: For the previous 10 years

Past statements for the following accounts are available free of charge in Macquarie Online Banking and the Macquarie Mobile Banking app:

- Macquarie Transaction and Savings Account: Since account opening

- Macquarie Cash Management Account and Macquarie Cash Management Accelerator Account: For the previous 10 years

- Macquarie Consolidator Cash Account: For the previous 10 years

- Macquarie Vision Cash Account: For the previous 10 years

Macquarie Term Deposit statements are not available online. Call us on 1800 806 310 if you need a statement.

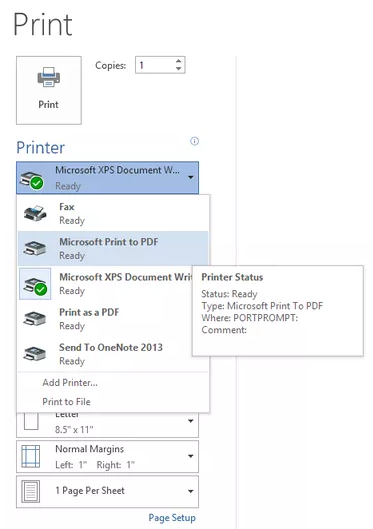

Formatting your bank statements

It’s important to keep in mind that your bank statements and transaction history need to be in a particular format to be accepted by your lender. This means screenshots are not considered valid.

Printing and scanning with a traditional scanner

Most online banking websites will give you the option to print out your bank statements or transaction history. You can then scan this document back in and attach it to an email to send to your lender or broker

Printing and scanning with a virtual scanner

How to print to PDF:

- Select a file in any application that prints and open it.

- Choose “File” > “Print”.

- Choose “Adobe PDF” from the list of printers in the print dialog box.

- Click “Print” to use the Acrobat PDF printer.

- Click “OK” and enter a new file name for your PDF. Save to your desired location.

How to print to PDF in windows :

To Print to PDF in Windows 10, simply open up your document in a text editor like Microsoft Word and click File > Print. (You can do this from any program that lets you print — not just Word, and not just with a text document.) Under Printer or Destination, choose Print as a PDF.

Save as a PDF

This option is actually the quickest and easiest option. When viewing your transaction history, simply select your date range then click ‘print’ where you will need to adjust your print settings so that the destination of your print job reads ‘Print to PDF’ or ‘Save as PDF’.

This will download or save the file to your computer, allowing you to then attach it to an email.

Providing the correct documentation is essential when it comes to applying for a mortgage, and your bank statements and transaction history are no exception. In fact, these are arguably the most important documents you’ll provide to a lender since they help solidify your status as a responsible lender.

By referencing the tips in this article, you can easily provide all the banking history your lender needs to continue with your mortgage application.

Feeling overwhelmed by all the documentation you have to provide with you mortgage application? Team at the Finance Circle Group can help make applying for a mortgage as streamlined and stress-free as possible.