Get the basic facts before applying for a home loan, investment property loan, business loan or a car loan. We have created some useful guides and resources to help you through for each stage of your buying journey.

Home Loan Tips and Answers

Tips for applying for a mortgage

Understanding your borrowing capacity

Fixed vs Variable loans

Thinking of breaking Fixed Rate ?

Is an Offset Account a good choice

What is a Bridging Loan

What is Lending Value Ratio (LVR)

10 Helpful hints for building a home

7 Steps For Working Towards Improving Your Credit Score

Thinking of Buying an Investment Property ?

How to Refinance in 5 eas y steps

Principal and Interest vs Interest Only; a thousand dollar question!

First Home Buyers: How to buy with just a 5 per cent deposit

6 reasons to refinance your home loan

Can your profession save you on your Home or Investment Loan?

Do’s and Don’ts of Buying your First Home

Refinance Tips

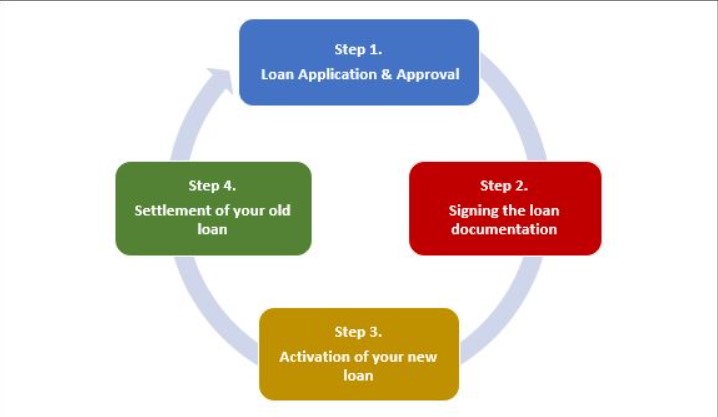

Refinance in 5 easy steps

6 reasons to refinance your home loan

Can refinance save you thousands ?

How to refinance your mortgage to buy an investment property

Valuation of your property

9 Tips to Prepare For Your Property Valuation

FAQ – Home Loan and Investment Loans

Frequent Asked Questions

Understanding Lender’s Mortgage Insurance

Car and Asset Finance Tips

Summery of different car finance

Property Buying and Selling Tips

Selling property video

Buying property video

Suburbs to invest in Melbourne 2020, possibly

Building a new home or renovating an existing home ? it is important to engage Finance and Mortgage Brokers such

The Home Guarantee Scheme (HGS), is an Australian Government initiative to help you buy or build your home sooner. We're proud to

Lenders are being more selective when it comes to certain suburbs. Here’s why. We all have suburbs we wouldn’t want

The days of questioning if a mortgage broker was recommending you a loan because it was the best for you

FASTRefi or Rapid Refinance is a unique refinance process that uses title insurance underwritten by First Title to allow lenders

Self Managed Super – Limited recourse loan Some people are interested in the ability to purchase property within a Self-Managed

Your credit score, may also referred to as Equifax Score, is used by some of your potential lender to determine

Your living expenses play an important part in your broker, or the bank assess your home loan application. To work

The prudential regulator APRA on Wednesday ordered banks to lift the “buffer” they add to market interest rates when assessing borrower capacity

The state has launched a new home-buyer fund, under which it will pay 25 per cent of the property purchase